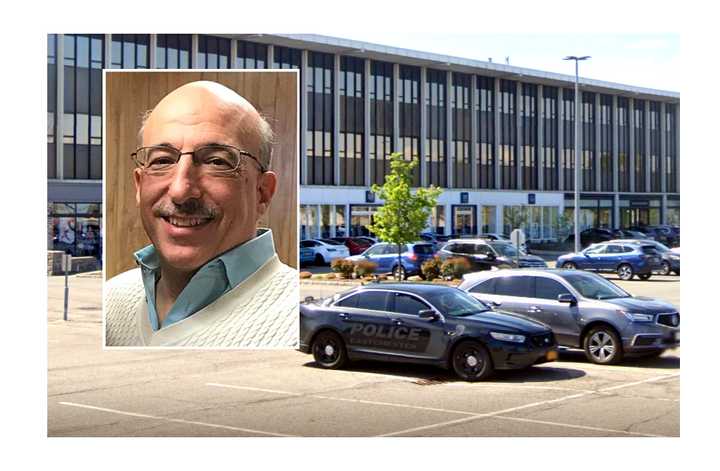

Jack N. Sardis, 66, of Englewood Cliffs admitted that he schemed to con the IRS with his partner, George Sanossian, 70, of Scarsdale, out of a small CPA office in a massive Westchester County shopping center.

Sardis also offered to do business elsewhere, telling one client "I can meet you at my firehouse,” according to an IRS complaint.

The clients benefitted to the tune of $2 million in unreported income, said U.S. Attorney for the Southern District of New York Damian Williams.

In the end, it cost the IRS $652,884, he said.

It wasn't what you'd call sophisticated.

The schemers employed an elementary scheme, directing clients to cut checks to a shell company account that they then tapped, Williams said.

They kept some of the money -- as fees -- and returned the rest to the clients, he said.

In this way, the partners concealed clients’ personal incomes, as well as how much those companies paid their employees, the U.S. attorney said.

The pair had help from partners and other members of Sanossian, Sardis & Co. in Eastchester, according to the Internal Revenue Service complaint on file in White Plains, NY.

Those people weren't indicted or identified, indicating that they cooperated with the investigation.

Some of the clients spent the money on themselves and didn't report it as income on their federal or state tax returns, according to the complaint.

Others used it for payroll but didn't report it. Nor did they withhold income taxes or deduct contributions to Social Security and Medicare, it ways.

Williams didn't say how much the CPAs kept for themselves.

Sardis has been a volunteer firefighter in Englewood Cliffs -- and an assistant Boy Scout master -- for nearly 30 years. He was among the heroes who rescued survivors at Ground Zero on 9/11.

He and Sanossian took deals from the government rather than risk the potential consequences of a trial in the tax fraud case.

Sanossian went first, pleading guilty to conspiracy to defraud the IRS on May 29. Sardis pleaded guilty to the same charge on Wednesday, June 5.

The federal judge who approved the pleas in White Plains scheduled Sardis's sentencing for Sept. 26. Sanossian will go two days before that.

"This case serves as a reminder to all Americans that they are required to truthfully report their earnings and that criminal penalties could await those who fraudulently deceive the IRS, as George Sanossian and Jack Sardis have learned," Williams said afterward.

“Schemes to conceal and reduce federal income and payroll tax liability, such as those utilized by Sardis and Sanossian, are unfair to every taxpayer who obeys the law and pays their fair share," IRS-CI Special Agent in Charge Thomas M. Fattorusso added.

Click here to follow Daily Voice Cedar Grove and receive free news updates.